Part 1: What is Dollar Cost Averaging

Part 2: Dollar Cost Averaging: Pros and Cons

Introduction to Dollar Cost Averaging for Kids, Teens and Beginners

This video explains the concept of Dollar Cost Averaging or Constant Dollar Plan in a simple, concise way for kids and beginners. It could be used by kids & teens to learn about Dollar Cost Averaging, or used as a money & personal finance resource by parents and teachers as part of a Financial Literacy course or K-12 curriculum.

Suitable for students from grade levels:

- Elementary School

- Middle School

- High School

The topics covered are:

- What is Dollar Cost Averaging or Constant Dollar Plan

- How does this investment strategy work, and always make money in the stock market

- Detailed example

- Its advantages / pros

- Its disadvantages / cons

- How to implement this investment strategy

Part 1: What is Dollar Cost Averaging

An investment strategy that always makes money

Is there an investing strategy using which you can always make money?

People usually try to time the market, which means they want to buy when the stock market is at the bottom, and sell when it’s at the top.

However, this doesn’t work most of the time, since consistently predicting market tops and bottoms is not possible. The only strategy that has proven to give consistently good returns is Dollar Cost Averaging.

What is Dollar Cost Averaging?

It is an investment strategy where you invest a fixed dollar amount in a stock, mutual fund or ETF periodically – usually every month – irrespective of the stock price, and without worrying about market tops and bottoms.

Click to Tweet

Why does this strategy always work?

You know that stock market is very volatile, which means that the prices can change drastically in the short term. However, we also know that the stock market always goes up in the long term.

When you invest a fixed amount periodically, you buy less stocks when the stock price is high, but when the stock price goes down, you buy more stocks for the same amount. That way, your average purchase price per stock stays low over time.

That is why this strategy gives great returns in the long term.

Can you give me an example?

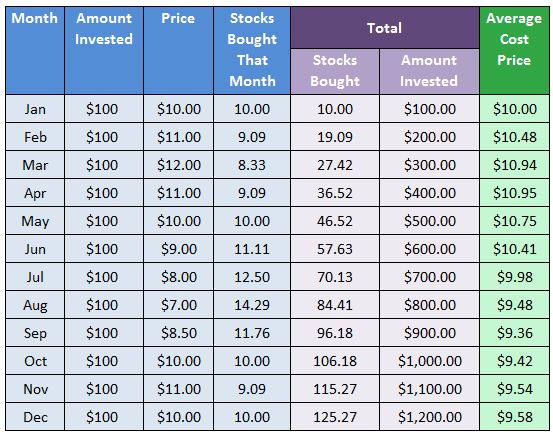

Let’s say you invest $100 in an S&P 500 based index fund every month for 12 months.

The price fluctuates throughout the year, but as you can see in the chart, even when the price at the beginning and end of the year is the same, your average cost price per stock is lower, and you can make a profit if you sell.

Whereas if you had made your entire purchase at the beginning, you would have not made any gain at the end of the year.

Are there any other advantages of Dollar Cost Averaging?

Sure there are. But that’s a topic for another time…

Part 2: Advantages and Disadvantages / Pros and Cons

You explained how I can always make money using Dollar Cost Averaging.

Does it have any other advantages?

Apart from providing consistent returns, the biggest advantage of Dollar Cost Averaging is to remove the emotion and anxiety from investing – you invest a fixed sum at a fixed time, without worrying about whether the market is going up or down.

Normally, when a stock’s price is going down, people avoid buying the stock thinking it is not performing well. But with Dollar Cost Averaging, you would continue to buy the stock even while its price is going down – and why not? You’re getting the stock at a discount!

Wouldn’t you be happy buying your favorite pair of shoes at a discount?

Are there any disadvantages of Dollar Cost Averaging?

A perfectly executed strategy of buying at the lowest price and selling at the highest price can theoretically give a better return – something Dollar Cost Averaging can’t.

However, this is not a real disadvantage because it’s impossible to time the market consistently.

How can I implement the strategy of Dollar Cost Averaging?

Do I need to remember to invest the amount every month? That’s sounds hard!

No, most brokerages can help you automate this process – you just need to tell them how much money to invest, where, and how often, and they would take care of investing the money on your behalf.

And if you are investing through a 401k plan, then you are already taking advantage of this strategy!

Note: Dollar Cost Averaging is also known as Constant Dollar Plan.

Video Featured in the Below Financial Literacy Course for Kids & Teens

Download Transcript: Ideal for Use by Teachers in their Lesson Plan to Teach Kids & Teens

Part 1: What is Dollar Cost Averaging

Part 2: Advantages and Disadvantages / Pros and Cons

Podcast

Part 1: What is Dollar Cost Averaging

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

Everything you need to know about Dollar Cost Averaging: What is Dollar Cost Averaging or Constant Dollar Plan, Is it an investment strategy that always makes money in Stock Market, How does Dollar Cost Averaging work, An example of Dollar Cost Averaging or Constant Dollar Plan, Advantages of Dollar Cost Averaging, and more.

Show notes and transcript at: https://www.easypeasyfinance.com/dollar-cost-averaging-for-kids-stocks-mf/

Part 2: Advantages and Disadvantages / Pros and Cons

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

Get to know all the pros and cons of Dollar Cost Averaging or Constant Dollar Plan: Advantages of Dollar Cost Averaging, Disadvantages of Dollar Cost Averaging, How to implement the strategy of Dollar Cost Averaging, and more.

Show notes and transcript at: https://www.easypeasyfinance.com/dollar-cost-averaging-for-kids-stocks-mf/