Part 1: What is Compound Interest, What is Compounding, A Detailed Example

Part 2: Why is Compound Interest Important, The Rule of 72

Part 3: Importance of Saving Early and the Effect of Compounding, A Detailed Example

Introduction to Compounding and Compound Interest for Kids and Teens

This video explains the concept of compound interest in a simple, concise way for kids and beginners. It could be used by kids & teens to learn about compounding, or used as a money & personal finance resource by parents and teachers as part of a Financial Literacy course or K-12 curriculum.

Suitable for students from grade levels:

- Kindergarten

- Elementary School

- Middle School

- High School

The topics covered are:

- What is compound interest

- A detailed example of compound interest

- Why is compound interest important

- Compounding and the rule of 72

- Starting to invest early to take advantage of compounding

- Starting early vs investing more: A detailed example

Old version

- What is Compound Interest

- An Example of the Power of Compounding

- Does a bank account give compound interest

Infographic: Click Here to Download

What is compound interest?

In very simple terms, compound interest is interest on interest.

It is interest that applies to the initial contribution or loan – called principal, and also on accumulated interest from previous years. As more time passes, the rate of growth accelerates. This effect is called compounding.

This is fantastic when it comes to your investments as they can grow exponentially, but devastating when it comes to your loans as the amount you owe increases quickly sending you into a debt trap.

Can you give me an example?

Let’s say you invest $1,000 and earn 10% interest every year.

After one year, you’d earn $100 – which is 10% of $1,000, and have a total of $1,100. But the second year, you’d earn 10% of $1,100 (not just the principal of $1,000), so your earnings would be $110.

This would keep repeating every year, and your balance would increase exponentially.

After 20 years, your original $1,000 would grow into over $6,700 thanks to compound interest. This is over double the $3,000 you’d get with simple interest, where interest is only earned on the principal of $1,000.

Why is compound interest important?

Compound interest can be your friend or your enemy depending on whether you are investing or borrowing.

It is crucial for investing and building wealth. Because your money grows faster over time, the earlier you start investing, the exponentially more money you’ll have as your money has more time to grow.

If you started investing at age 40 and invested $100 per month into the stock market, you’d have $77,000 by the time you’re 60.

However, if you invested the same amount each month but started investing earlier at age 20, you’d have $700,000 – almost ten times more money.

This just goes to show how crucial it is to start investing early as you can really take advantage of compounding.

Compound interest is just as important when it comes to managing debt successfully. It works against you when you borrow, since you accrue compound interest on any money you haven’t paid back within the stated time period.

Credit card companies charge compound interest on your unpaid balance, making it skyrocket and way harder to pay off in full.

By focusing on paying off your high-interest debt fast, you can avoid paying back way more than you originally borrowed and preserve any wealth you have accumulated or are trying to.

I’ve heard about the rule of 72. How does it relate to compound interest?

Using the rule of 72 is a quick way to easily estimate how long it will take for you to double your investment using compound interest. Just divide 72 by your annual interest rate.

For example, if your investment earns 11% interest, it would take about 6 ½ years to double your money.

How important is it to start investing early to take advantage of compounding?

Many people wait too long to invest because they think they need to save up a lot of money to start investing.

But thanks to compound interest, the most important factor is time: start investing as early as you can, even if it’s a small amount.

Investing just a dollar a day starting in your 20s can turn into hundreds of thousands of dollars by the time you retire. Saving small amounts starting early is far better than saving higher amounts later on in life.

Can you give me an example?

Let’s say Sally starts investing $100 a month starting at age 20. By age 65, she would have invested $54,000. And with an average stock market return of 11%, she would have grown it to $1.2 million!

Mike on the other hand decides to wait until he turns 50. He then starts with an initial investment of $10,000, followed by $1,000 monthly for the next 15 years – adding up to a total investment of $190,000.

He would still end up with only $480,000 by the time he is 65!

Even after investing almost 4 times more than Sally, Mike has less than half of Sally’s earnings just because he waited too long! This shows the magical power of starting early even if you don’t think you have a lot of money!

What is Compound Interest: Old Version

Howdy Wall Street Willy. I have a really big question for you.

What is compound interest?

Compound interest is interest on interest.

What do you mean by interest on interest?

If you have $100 in the bank and has 10% rate of interest, on the first year, it’ll be $10 in interest because 10% of $100 is $10. But in the second year, the interest will be $11 because the interest for a $100 is $10, and for the extra $10 is another $1. So the total is $11 for the second year, but only $10 for the first year.

Well, but why is that even important? It’s just interest on interest on interest. Who cares?

Well, it shows that the longer you invest your money for, the quicker your money grows and its growth gets accelerated. And you can make a lot of money with compound interest.

An Example of the Power of Compounding

Well then, I really like compound interest. But could you give me a long term example?

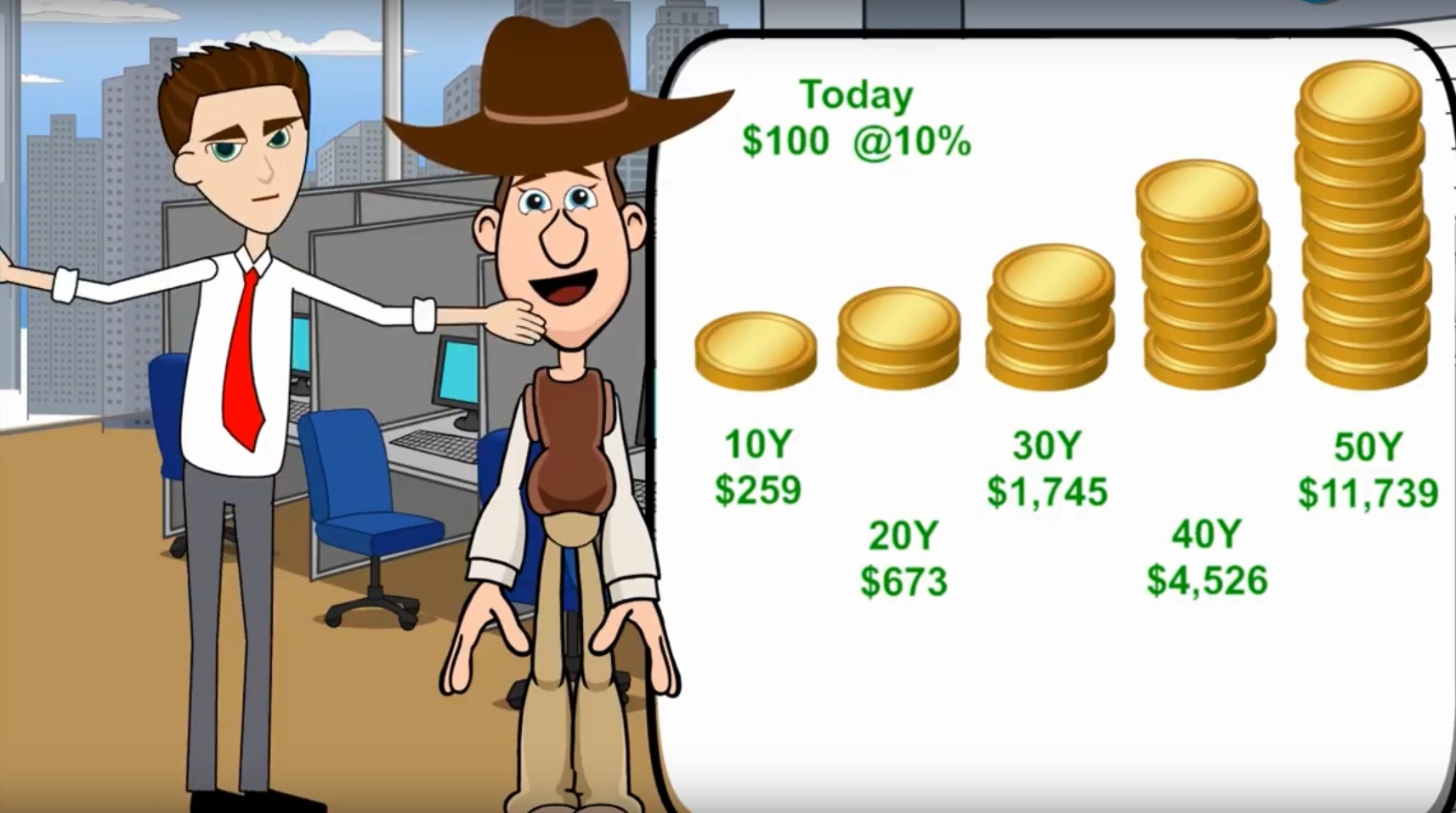

Okay. If there’s $100 at a 10% rate of interest, in 10 years it’ll turn into $259. In 20 years, I’ll turn into $673. In 30 years, it’ll turn into $1,745. In 40 years, it’ll turn into $4,526. And in 50 years, it’ll turn into $11,739!!

$100 at a 10% rate of interest

- 10 years: $259

- 20 years: $673

- 30 years: $1,745

- 40 years: $4,526

- 50 years: $11,739

Whoa! That’s so awesome! A $100 at a 10% rate of interest can turn into $11,739. That’s so awesome!!

Yes, it is very awesome. That is why compound interest is very important.

Does my bank account give compound interest?

If you leave the interest that you got in your bank account, then yes, you would receive compound interest.

That’s great! But does my piggy bank give compound interest?

No, it does not even give interest – unless your parents secretly sneak money into it!

Thank you very much for teaching me about compound interest, Wall Street Willy.

You’re welcome. Remember, finance is your friend!

Video Featured in the Below Financial Literacy Course for Kids & Teens

Download Transcript: Ideal for Use by Teachers in their Lesson Plan to Teach Kids & Teens

Podcast: What is Compound Interest?

Fun, informative and concise episodes by a 16-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

Everything you need to know about compound interest: What is compound interest, how does it work, why compound interest is so important (the power of compounding), a long term example of compound interest, and more. Show notes and transcript at: http://easypeasyfinance.com/what-is-compound-interest/