Introduction to Banks and Banking for Kids and Teens

This video explains the concept of banks and banking in a simple, concise way for kids and beginners. It could be used by kids & teens to learn about banks, or used as a money & personal finance resource by parents and teachers as part of a Financial Literacy course or K-12 curriculum.

Suitable for students from grade levels:

- Kindergarten

- Elementary School

- Middle School

- High School

The topics covered are:

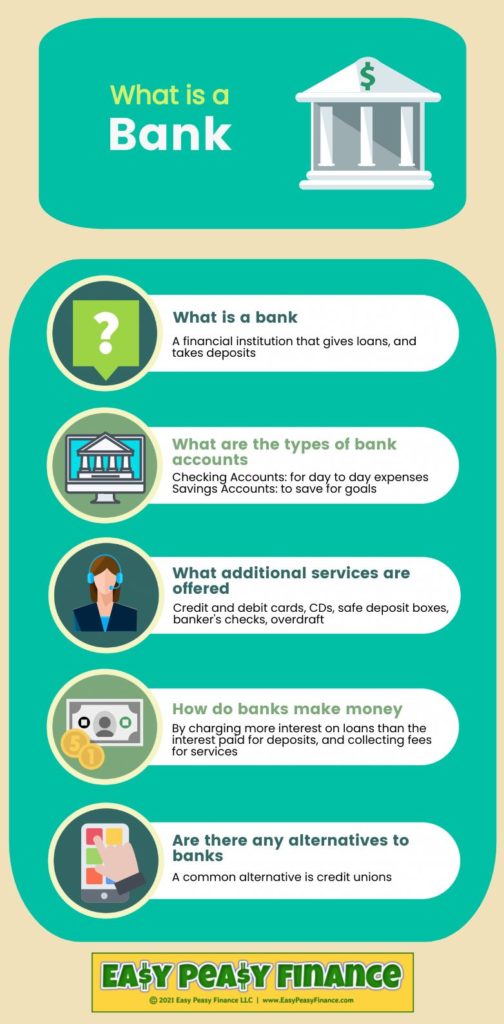

- What is a bank

- Who uses banks

- Different types of bank accounts

- Different types of loans

- Other services provided by banks

Infographic: Click Here to Download

What is a bank?

A bank is a type of financial institution that helps with money management.

Banks take deposits, give loans, issue checks, offer credit & debit cards, process payments and provide other services related to managing your money.

Banks’ primary function is to pool deposits from many people and give that money out to others as loans.

Banks pay interest on the deposits and charge interest on the loans.

Who uses banks?

Individuals like you and me, companies, and governments all use banks for depositing money, taking out loans, and the other services they provide.

What types of accounts do banks offer?

The main types of accounts banks offer are checking accounts and savings accounts.

Checking accounts are for day-to-day use – such as paying bills, transferring money, withdrawing from an ATM and collecting salary from your job. They are linked to a debit card and usually pay very low interest.

Savings accounts are meant for your savings – whether it’s for a big purchase, short term goal, or emergency fund. They can pay higher interest – sometimes over 4%.

If you don’t need the money for a longer duration, you can go for a Certificate of Deposit or CD, which pays higher interest than a savings account, but your money is locked in for a certain fixed duration.

Most banks are insured by the Federal Deposit Insurance Corporation or FDIC, which means your money is safe up to $250,000.

What types of loans do banks provide?

Banks offer many types of loans such as mortgages or home loans, personal loans, home equity loans, small business loans, student loans, and car loans.

Banks earn money by charging a higher interest rate on these loans than they pay depositors on the balance they keep in bank accounts.

What other services do banks provide?

Banks issue credit cards, debit cards, and banker’s checks. They have ATMs for easy withdrawal of cash, depositing checks, etc. and safety deposit boxes for safekeeping of valuables.

They also provide services like direct deposit, overdraft, money order, currency exchange, check cashing, and money transfer through ACH, wire transfers, and peer-to-peer transfers.

Some banks also offer investment accounts, wealth management services, and more. Banks may charge fees for some or all of these services.

What is a Bank: Old Version

I heard my parents talk about putting their money in a bank. But…

What is a bank anyway?

A bank is the type of financial institution that gives loans, which is money that they lend you which over certain amount of time, you pay them back with interest.

And they also take deposits. For example, you can give them money, which you can put into either checking or savings account, or a CD which is a certificate of deposit.

Banks also issue checks and debit cards so that you can access your money.

Well, is there anything else that banks do?

Banks can also issue credit cards, give mortgages – which is a loan on your house, other types of loans and issue banker’s checks.

Well, how do banks even make money?

The difference between the interest that they charge on the loans that they give you, and the interest that they pay on deposits that you make in a checking account, saving account or CD, is one of the ways that they make money.

They also make money by fees that are charged for services like issuing banker’s checks.

Well, are there different types of banks?

Yes, there are.

There are traditional banks with branches that you could visit, or you can visit them online at their website.

But there also internet only banks, where all of the transactions are made completely online and they do not have any physical presence.

I keep hearing about investment banks. Well, what are they?

Investment banks are banks that work mainly with companies. But that’s a topic for another time.

Thank you very much for telling me about a bank, Wall Street Willy.

You’re welcome, Sooper Cooper. Remember, finance is your friend!

Video Featured in the Below Financial Literacy Courses for Kids and Teens

Download Transcript: Ideal for Use by Teachers in their Lesson Plan to Teach Kids and Teens

Podcast: What is a Bank?

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

All you need to know about bank accounts: What is a Bank Account, Why would you use a bank account, How safe is the money in a bank account, Are there different types of bank accounts, and more.

Show notes and transcript at: https://www.easypeasyfinance.com/bank-account-for-kids-financial-literacy/