Part 1: What is a Credit Card, How Does a Credit Card Work

Part 2: Pros & Cons of Credit Cards, Should You Use a Credit Card

Introduction to Credit Cards for Kids and Teens

This video explains the concept of credit cards in a simple, concise way for kids and beginners. It could be used by kids & teens to learn about them, or used as a money & personal finance resource by parents and teachers as part of a Financial Literacy course or K-12 curriculum.

Suitable for students from grade levels:

- Kindergarten

- Elementary School

- Middle School

- High School

The topics covered are:

- What is a credit card

- How does a credit card work

- Advantages of a credit card

- Disadvantages of a credit card

- Should YOU use a credit card

Old version

- What is a Credit Card

- What is the rate of interest

- When do you pay back the money

- What are the benefits and rewards

- Where can you get a Credit Card from

- What are the factors to consider while selecting a credit card

- What if you cannot repay the money

Infographic: Click Here to Download

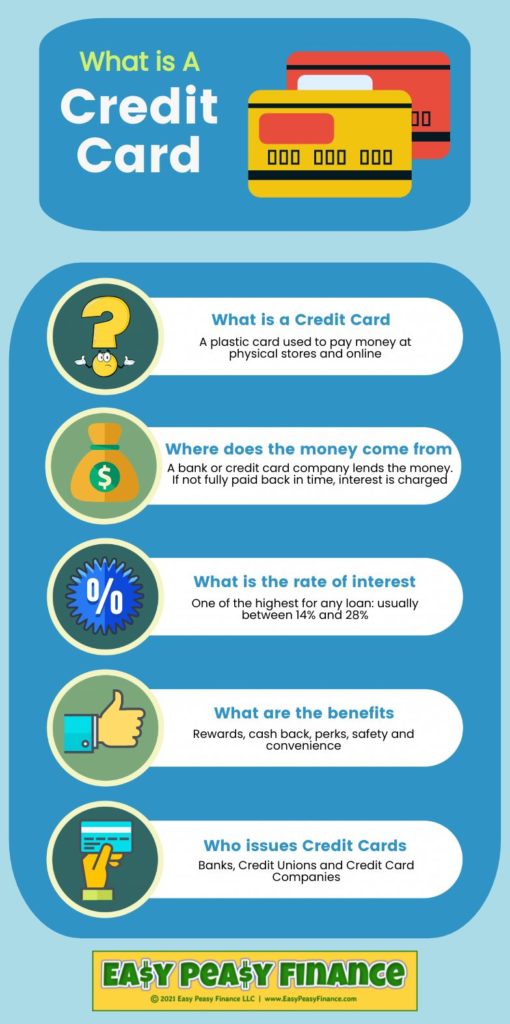

What is a credit card?

A credit card is a plastic or metal card that offers a short term loan primarily to make purchases in store or online.

You can also use a credit card to pay bills, withdraw cash from ATMs, and more.

Credit cards are issued by banks, credit unions, and other financial institutions, as well as retail stores. They have a credit limit, which is the amount you can spend using that credit card.

You have to pay the money back to the credit card issuer either in full every month, or with interest over time.

How does a credit card work?

Your credit card is issued by a bank like Bank of America, or a financial services company like American Express. This involves an approval process where the card issuer determines your eligibility and credit limit based on your credit score, income, etc.

When you use a credit card, the transaction is processed on a payment network like Visa or Mastercard. The card issuer pays the merchant on your behalf, and at the end of each billing cycle you get a statement.

It lists all your transactions that month, along with the total amount you owe – also called your card balance – and the date by which you need to make the payment.

If you pay your card balance in full every month, you’re not charged any interest. However, if you carry a balance from month to month, you are charged very high interest on your balance.

While a credit card is borrowed money, it works more like a line of credit than a traditional loan. There is a limit up to which you can spend on your card.

But as you pay off your balance in part or in full, your available credit goes back up until it reaches the original limit.

What are the advantages of a credit card?

The main advantages of credit cards are rewards, convenience, and the ability to build credit.

Most credit cards come with rewards – like cash back or miles – that are very lucrative for consumers. In addition, credit cards are a safe and convenient way to pay both in store and online as you don’t have to carry any cash. Credit cards also help you keep track of your spending.

While it may not be ideal, credit cards do offer flexibility by allowing you to pay for an emergency or make a large purchase and pay it off over time. They also offer consumer protection – for instance if there is a fraudulent transaction or your card is stolen, you won’t be charged for the purchases you didn’t make.

Also, unlike traditional loans, you never have to pay interest if you pay off your balance in full every month!

Lastly, credit cards can help improve your credit score. This is especially true if you make timely payments, and spend significantly less than your credit limit.

What are the disadvantages of a credit card?

Credit cards are one of the costliest forms of debt, and can charge interest upwards of 25%. The rewards and convenience they offer can be a double edged sword, making it extremely easy to overspend.

And when you have to actually pay off the balance, it is tempting to not pay everything off.

This can quickly become a vicious cycle, with you making just the minimum monthly payments and being forced to pay thousands of dollars in interest.

Credit cards can also charge various fees like annual fee, late payment fee, balance transfer fee, or foreign transaction fee.

In addition, they can hurt your credit score if you don’t make timely payments, carry too high of a balance, apply for new cards too often, or close unused credit cards.

Should I use a credit card?

If you know you’ll be responsible with your credit card by not overspending and paying off your balance in full every month, the ability to build good credit without paying interest, and rewards like cash back or points make them a great choice.

However, if there’s a good chance you’ll end up overspending and will carry a balance, you should definitely avoid credit cards.

Remember, cash back or miles will mean nothing if you’re stuck paying 20+% interest on your credit card balance. Instead, you can pay using a debit card or cash.

What is a Credit Card: Old Version

Howdy Wall St. Willy! I saw someone using a credit card at the mall. But…

What is a credit card anyway?

Well, a credit card is a plastic card that you use to pay at stores and online.

But where does that money that you use to pay come from?

Well, a bank lends it to you but you have to repay that money. If you repay late, then you’ll be charged interest.

Awww!

How much interest do you get charged?

Well, it is one of the costliest forms of credit – so you get charged between 14% and 28% interest per year. But to qualify for a lower interest rate, you need a higher credit score.

Is there any other fee?

Yes, some credit cards have a $25 to $500 annual fee, which is every year.

How long do I have to pay back the bank?

Normally you get 30 days where you are not charged interest but after that you’ll be charged interest.

What are the benefits of a credit card?

Well, you get free credit for up to 30 days, you get the convenience of not carrying any cash and you can consolidate or combine all the payments into one.

You can also get rewards.

What kind of rewards?

The rewards can be in the form of points or miles. They can be exchanged for different things like cash back, airline tickets and merchandise.

Where can I get a credit card from?

Well, you can get them from banks, credit unions and credit card companies.

You can apply for them online by visiting their website. You need your address and Social Security Number.

But instead of going through all that hassle, can I just make my own credit card?

YOU CANNOT!

Okay Okay Okay!

Well, what should I consider while choosing a credit card?

Well, you should consider the interest rate (the lower, the better), the annual fee if it has any. But, if it does, then the lower the better.

And rewards – depending on what you do more, you can choose between a mile card or a cash back card.

Click to Tweet

Well, what if I cannot repay the money?

Well then, the credit card debt will keep on piling up because of the high interest rate. That would also negatively impact your credit score.

That’s not good. Can anything be done in this situation to help make it better?

Yes, but that’s a topic for another time.

Thank you very much for explaining to me what a credit card is, Wall St. Willy.

You are welcome, Sooper Cooper. Remember, Finance is Your Friend!

Video Featured in the Below Financial Literacy Course for Kids & Teens

Download Transcript: Ideal for Use by Teachers in their Lesson Plan to Teach Kids & Teens

Podcast: What is a Credit Card?

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

All you need to know about a Credit Card: what is a credit card, where does the money that you use to pay come from, much interest do you get charged, what are the charges and fees for credit cards, how long do you have to pay back the bank, what are the benefits of a credit card, what kind of rewards do credit cards offer, where can I get a credit card from, what should you consider while choosing a credit card, what if you cannot repay the money or the credit card bill, and more.

Show notes and transcript at: https://easypeasyfinance.com/what-is-a-credit-card/