Introduction to the Fed or Federal Reserve for Kids and Teens

This video explains Fed or Federal Reserve in a simple, concise way for kids and beginners. It could be used by kids & teens to learn about the Fed, or used as a money & personal finance resource by parents and teachers as part of a Financial Literacy course or K-12 curriculum.

Suitable for students from grade levels:

- Kindergarten

- Elementary School

- Middle School

- High School

The topics covered are:

- What is the Federal Reserve

- What exactly does the Fed do – its function

- How is the Federal Reserve structured / organized

- Do countries other than the US also have a Federal Reserve

What is the Federal Reserve?

The Federal Reserve System, also known as the Federal Reserve or just the Fed, is the central bank of the US.

It was created by the US Congress in 1913 because the US needed a central institution to control its monetary system and to deal with financial crises.

The Fed is the backbone of the country’s financial system and is responsible for ensuring its safety and stability.

What exactly does the Fed do?

The main function of the Federal Reserve is to make sure the US financial system remains stable through its monetary policy. This means to ensure inflation is under control, unemployment levels are low, prices aren’t volatile, interest rates are conducive to economic growth, etc.

The Fed supervises and regulates banks to ensure there is no misconduct and peoples’ money is safe.

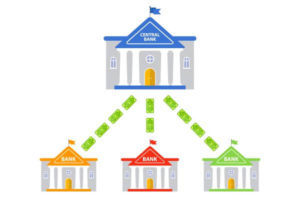

It is known as the banker’s bank as it provides financial services to other banks. It also acts as the US government’s bank. The Fed acts as the lender of last resort by helping struggling companies avoid bankruptcy.

Unlike a lot of other central banks, the Fed doesn’t produce dollar bills or coins, although it controls the supply and flow of money through its monetary policy.

How is the Federal Reserve structured / organized?

The Fed is made up of three main parts.

The Board of Governors (also known as the Federal Reserve Board or the FRB), consists of 7 people that are appointed by the President.

There are 12 regional Federal Reserve banks that regulate and supervise commercial banks for a specific region of the US.

Lastly, there is the Federal Open Market Committee (FOMC) made up of all 7 members of the FRB and the presidents of 5 of the regional Federal Reserve banks. It sets monetary policy and conducts open market operations, which impact the country’s money supply and credit availability.

What about countries other than the US? Do they also have a Federal Reserve?

Most countries have their own central bank that plays a role similar to the US Federal Reserve.

But that’s a topic for another time…

Download Transcript: Ideal for Use by Teachers in their Lesson Plan to Teach Kids & Teens

Podcast: What is the Fed or Federal Reserve

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

Everything you need to know about the Federal Reserve: What is the Federal Reserve, What exactly does the Fed do, How is the Federal Reserve structured, What about countries other than the US – do they also have a Federal Reserve, and more.

Show notes and transcript at: https://www.easypeasyfinance.com/fed-federal-reserve-for-kids-beginners/

Excellent summarization! This helped me understand the basics of The Fed.

Thanks a lot, Kate!