Part 1: What is a 401k Account, Contribution Limits, Advantages and Disadvantages

Part 2: 401k Account Employer Match / Contribution and Vesting Schedule

Introduction to 401k Account for Kids and Teens

This video explains the concept of a 401k Account in a simple, concise way for kids and beginners. It could be used by kids & teens to learn about 401k plans and retirement planning, or used as a money & personal finance resource by parents and teachers as part of a Financial Literacy course or K-12 curriculum.

Suitable for students from grade levels:

- Kindergarten

- Elementary School

- Middle School

- High School

The topics covered are:

- What is a 401k Account & how does it work

- Can the money be invested in anything

- 401k contribution limits

- Pros and cons of a 401k account

- 401k employer match / contribution

- Employer match / contribution vesting schedule

What is a 401k Account?

Can you tell me about a 401k?

A 401k is a tax deferred account offered by employers as a part of their benefits package, through which you can invest money for your retirement.

Since these are offered by employers, you can open a 401k account only if your employer offers it.

How does a 401k work?

You decide how much of your income you want to set aside for 401k, and the amount gets withheld from your paycheck and gets deposited in your 401k account.

You then choose how to invest this money.

Can I invest the money in my 401k account into anything? Or are there any restrictions?

No. Your employer offers a specific set of investment options from which you have to choose.

These options usually include various mutual funds or index funds, which may be investing in stocks or bonds, within the US or internationally, etc. The options could also include lifecycle funds, or target date funds, that are designed specifically for retirement planning.

How much can I invest in a 401k account? What is the yearly contribution limit?

The government decides the maximum amount that can be invested in a 401k account, and it changes from one year to another based on inflation.

For 2020, the 401k contribution limit is $19,500. People over the age of 50 can invest another $6,500 as a catch-up contribution.

What are the advantages of a 401k account?

The biggest benefit of a 401k account is employer matching. This means your employer also contributes money to your 401k for every dollar you contribute, up to a certain percent of your paycheck. This is essentially like getting free money from your employer!

Another big advantage of a 401k account is tax deferred investment. Your 401k contribution is pre-tax, which means you don’t pay income tax on the money you contribute. This reduces your tax for the year in which you make the contribution.

Your investments also grow tax free, and you only pay taxes when you withdraw money from your 401k account.

Are there any disadvantages of 401k accounts?

One disadvantage of a 401k is that the investment options are limited and defined by your employer, like we discussed earlier.

Another disadvantage of 401ks is that the money gets locked-in until your retirement – usually, any withdrawal before the age of 59 ½ incurs a penalty. But this isn’t necessarily bad, as it ensures that you are able to take advantage of the power of compounding while deferring payment of income tax, which can maximize your retirement savings.

Click to Tweet

You told me that one of the biggest advantages of a 401k account is the employer match. But can you explain it to me?

What is 401k employer match or matching contribution?

Employer match means that your employer also contributes money to your 401k account – in addition to the amount you contribute to it yourself. This is essentially like getting free money from your employer!

Click to Tweet

How much is the employer match?

How much the employer contributes depends on the specific employer, but it is usually up to a certain percentage of your pay.

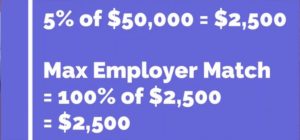

For example, your employer can offer a 100% match for up to 5% of your pay. So if you earn $50,000 a year, your contribution up to $2,500 to your 401k would be matched by your employer dollar for dollar. If you contribute more, the employer match is capped at $2,500, which is 5% of your pay.

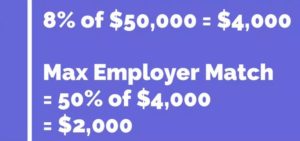

Some employers can offer a lower match too – for example, a 50% match for up to 8% of your pay. So if you earn $50,000 a year, your employer will contribute 50 cents for every dollar you contribute to your 401k up to $4,000, which is 8% of your pay. For example, if you contribute $2,000, your employer would add $1,000.

Wow, the employer match sounds amazing! So all the money the employer puts in my 401k account is mine?

401k Account Employer Match Vesting Schedule

Yes, it is. However, it may not immediately be yours. When the employer match becomes yours depends on the vesting schedule.

With some companies, the vesting is 100% – which means that the employer match becomes yours immediately. But with most companies, a certain percent of the employer match vests, or becomes yours, every year.

For example, a company can have a vesting schedule of 25% over 4 years, which means that 25% of the employer match vests at the end of every year, with all of the employer match becoming yours – or vesting 100% – at the end of 4 years. Usually, once you reach 100% vesting, all subsequent employer matches are immediately yours.

Is employer contribution counted towards the 401k yearly contribution limit?

No! This is another benefit of the employer match – it doesn’t count towards your yearly 401k contribution limit.

So when you take advantage of your employer match, you effectively contribute more to your 401k account and further accelerate saving for your retirement.

Video Featured in the Below Financial Literacy Course for Kids & Teens

Download Transcript: Ideal for Use by Teachers in their Lesson Plan to Teach Kids & Teens

Part 1: What is a 401k Account, Contribution Limits, Advantages and Disadvantages

Part 2: 401k Account Employer Match / Contribution and Vesting Schedule

Podcast: 401k Account

Part 1: What is a 401k Account, Contribution Limits, Advantages and Disadvantages

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

All you need to know about 401k accounts: What is a 401k Account, How does a 401k work, Can you invest the money in your 401k account into anything or are there any restrictions, How much can you invest in a 401k account, What are the advantages of a 401k account, Are there any disadvantages of 401k accounts, and more.

Show notes and transcript at: https://www.easypeasyfinance.com/401k-account-explained-for-kids-beginners/

Part 2: 401k Account Employer Match / Contribution and Vesting Schedule

Fun, informative and concise episodes by a 10-year old, breaking down complex financial concepts in a way that kids and beginners can understand. Episodes cover personal finance topics like saving, investing, banking, credit cards, insurance, real estate, mortgage, retirement planning, 401k, stocks, bonds, income tax, and more, and are in the form of a conversation between a cowboy (a finance novice) and his friend, a stock broker. Making finance your friend, only at Easy Peasy Finance.

A little bit about me: I have been fascinated with the world of personal finance since I was 6! I love to read personal finance books, and keep myself updated on the latest by reading various personal finance magazines. My friends often ask me questions about finance because they find it complex and intimidating. That’s what inspired me to start my YouTube channel called Easy Peasy Finance when I was 8, and this podcast 2 years later.

Everything you need to know about 401k employer match and vesting: What is 401k employer match, How much is the 401k employer match, Is all the money the employer puts in your 401k account yours – Vesting Schedule, Is employer contribution counted towards the 401k yearly contribution limit, and more.

Show notes and transcript at: https://www.easypeasyfinance.com/401k-account-explained-for-kids-beginners/